3 Pot Stocks That Can Double Again In 2021

03 February 2021 - 9:30PM

Finscreener.org

Cannabis stocks have experienced a remarkable run after Joe

Biden won the Presidential race in late 2020. Investors are

optimistic about the decriminalization and eventual legalization of

marijuana at the federal level in the U.S. which has driven stocks

of several pot companies higher in the last two months.

While the legalization of cannabis in the U.S. might seem like a

distant dream, we have identified three pot stocks that are

fundamentally strong and which should continue to outpace the

broader markets such as the

S&P 500 this year.

Green Thumb Industries

The first stock on the list is Green Thumb Industries (OTC:

GTBIF), a company that is firing on all cylinders. In the

September quarter, Green Thumb sales soared 131% to $157.1

million.

This stellar growth in the top-line helped the company to

improve its operating cash flow margin from -1% to a healthy 45%

year over year. Green Thumb also managed to post a positive net

income for the first time ever in Q3 of 2020.

Green Thumb is valued at a market cap of $6.4 billion which

means its trading at a forward price to 2021 sales multiple of 7.7x

and a price to earnings multiple of 70.1x which is reasonable given

the company’s leadership position in the Land of Lincoln and a

rapidly expanding addressable market.

Cresco Labs

Shares of Cresco Labs (OTC:

CRLBF) were up 44% in 2020 and have already gained 25%

year-to-date easily surpassing returns of the S&P 500.

Cresco has a presence in nine states including

six of the 10 most populated regions in the U.S.

It is

a market leader in the state of Illinois which is one of the

fastest-growing markets for recreational marijuana products. Cresco

is also one of the largest wholesale distributors in California

which is the biggest cannabis market in the U.S.

Cresco is now eyeing expansion into Florida’s medical marijuana

market via its acquisition of Blume Wellness. Several other states

like Arizona and New Jersey have recently legalized pot which

indicates there are enough drivers for Cresco’s top-line

growth.

Analysts covering Cresco expect the company to increase sales by

270.5% to $476.24 million in 2020 and by 69.2% to $805.7 million in

2021. This growth will also allow the company to turn profitable by

the end of 2021.

IIPR

Investors can also look at an ancillary pot company- Innovative

Industrial Properties (NYSE:

IIPR) which is a real estate investment trust. Shares of IIPR

gained a mammoth 157% in 2020 and have risen over 6%

year-to-date.

IIPR stock is also attractive to income investors, given its

forward dividend yield of 2.5%. In the last year, IIPR increased

its dividend payouts by 24% making it one of the top picks for

investors seeking growth and dividends.

IIPR provides real estate capital to medical marijuana companies

operating in the U.S. It basically purchases properties from these

companies and leases them back to the operators via a

triple-net-lease agreement.

Medical marijuana companies get access to capital while IIPR

benefits from a predictable stream of cash flows. IIPR is focused

on growth via acquisitions and now has 66 properties in 17

states.

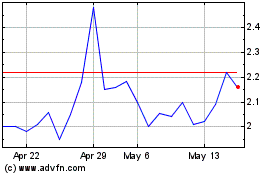

Cresco Labs (QX) (USOTC:CRLBF)

Historical Stock Chart

From Oct 2024 to Nov 2024

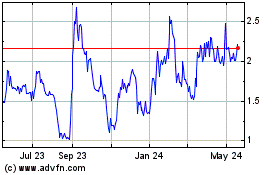

Cresco Labs (QX) (USOTC:CRLBF)

Historical Stock Chart

From Nov 2023 to Nov 2024